Imagine you are a parent searching for daycare. You want a place that is safe, affordable, and high quality—but there is a problem. Waiting lists are so long that many parents sign up before their child is even born, and you accept any place that is given to you. Clearly, the system is not working optimally.

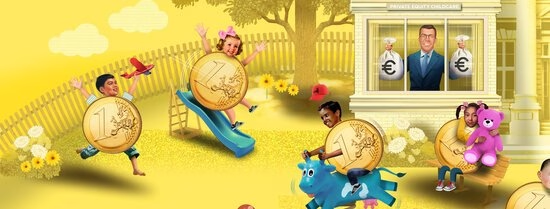

Moreover, with major Dutch government reforms planning to make daycare almost entirely free, this situation could even get worse as this will increase the demand for daycare. A big worry is that for-profit businesses may take advantage of this growing market, transforming an often essential service into a business strategy. In my research, I find that investment firms in the Netherlands are rapidly expanding their presence in childcare. This reshapes prices, quality, and competition in ways that affect families—and the economy.

For-profit ownership in daycare presents a trade-off. On one hand, private investors can bring efficiency, professional management, and economies of scale. Larger daycare chains may offer standardised care, improved compliance, and modernised facilities.

On the other hand, profit-driven daycare also introduces risks. With demand far exceeding supply, private firms may raise prices—especially when subsidies increase or when the market consolidates, reducing choice for parents. Private equity tends to restructure businesses to maximise profitability, which could lead to stronger financial management and higher compliance with regulations, but also cost-cutting measures that impact service quality.

Studying private equity in daycare

In this study, my co-author Dong Xu (Bayes Business School) and I aim to understand how private equity ownership impacts daycare pricing, quality, and market competition. By doing so, we shed light on whether financial investors improve childcare services or simply make them more expensive, especially in a market already struggling with high demand and upcoming policy changes.

To understand how private equity shapes the daycare market, we analysed data from thousands of daycare centres in The Netherlands between 2016 and 2023. We tracked ownership changes, pricing trends, and regulatory compliance using government records, company reports, and financial databases. By comparing private equity-owned centres to other providers, we identified differences in pricing, response to subsidies, and quality violations. Additionally, we studied how these centres adapted to stricter regulations. This approach allows us to separate natural market trends from the effects of private equity, providing a clearer picture of its role in shaping daycare accessibility and affordability.

Prices, quality, and competition

Firstly, we looked at how pricing was affected. When allowances rise, these centres adjust their prices more aggressively, capturing a larger share of the subsidy. In regards to quality, private equity ownership presents a mixed picture. These centres have fewer overall regulatory violations, particularly in administrative compliance. However, they initially struggled with staff-related violations but adapted better after stricter regulations were introduced in 2019.

Another concern is market competition. While private equity-owned daycares represent just over 10% of the market nationally, their share is much higher in districts where they operate, exceeding 30% in some areas. Its growing market influence could limit competition and parental choice over time.

Global trends and cross-sector impact

While this study focuses on the Netherlands, private equity’s influence on childcare is part of a broader global trend. In countries like the United States, the United Kingdom, and other European nations, similar concerns have emerged over rising daycare fees, market consolidation, and the tension between profit motives and service quality. This trend extends beyond childcare—healthcare sectors, including nursing homes and hospitals, have also seen increased private equity involvement, sparking concerns over affordability, staffing shortages, and patient outcomes. The growing role of financial investors in essential services raises pressing policy questions about competition, affordability, and long-term quality. Our results suggest a clear trade-off from private equity presence in the daycare market. They make daycare more expensive but overall quality improves.

‘Ultimately, the trade-off between efficiency and affordability is a political choice’

Political balance

A well-functioning daycare market is essential for families, yet balancing affordability, quality, and investment incentives remains a challenge. Private firms can help expand and optimise the sector, but their involvement comes at a cost—higher prices driven by the need for financial returns. From a policy standpoint, maintaining a healthy mix of non-private alternatives and enforcing strong checks on quality, competition, and financial risk-taking is crucial. Ultimately, the trade-off between efficiency and affordability is a political choice.

The Dutch daycare sector is already under pressure, and upcoming government reforms could significantly reshape the market. The plan to make childcare almost entirely free by 2027 raises new questions about pricing dynamics, market entry, and competition. Our research sheds light on how private investors operate in a sector with a vital societal function, informing future policy discussions.

About Dyaran Bansraj

Dyaran Bansraj is a lecturer in finance at Erasmus School of Economics. His research focuses on private equity, financial markets and competition, with an emphasis on buy-and-build strategies. He examines how consolidation by private equity shapes portfolio companies, market competition, and broader industry dynamics.

- Researcher

- More information

This item is part of Backbone Magazine 2025. The magazine can be found in E-building or Theil-building for free. Additionally, a digital copy is available here. Backbone is the corporate magazine of Erasmus School of Economics. Since 2014, it is published once a year. The magazine highlights successful and interesting alumni, covers the latest economic trends and research, and reports on news, events, student and alumni accomplishments.